The SDOW ETF presents a unique opportunity for investors targeting exposure to downsiderisk. By utilizing leveraged short selling tactics, enabling gains during, market contractions. It's crucial for investors to understand the inherent exposure associated with leveraged ETFs like SDOW before committing capital.

Comprehending the ETF's fundamental components and its adjustment pattern is essential for making strategic investment decisions..

- Moreover,, it's critical to consider the ETF's performance in diverse market environments.

- Because of the magnified nature of SDOW, investors should be prepared for potential drawdowns that can surpass those experienced in a conventional short position.

Leveraging ProShares UltraShort Dow30 (SDOW) in Dow Jones Bear Markets

ProShares read more UltraShort Dow30 (SDOW) provides a unique opportunity for investors seeking to benefit from potential downturns in the influential Dow Jones Industrial Average. This multiplied ETF aims to generate returns that are 2x the inverse of the daily performance of the DJIA. In a downward market, SDOW can serve as a valuable tool for reducing risk. However, it's crucial to grasp that leveraged ETFs like SDOW are complex instruments and should be approached with discretion.

- Weigh your risk tolerance carefully before participating in SDOW or any other leveraged ETF.

- Periodically review your investments and modify your strategy as market conditions change.

- Consult with a qualified financial advisor to determine if SDOW is right for your needs

Harnessing 3x Leverage with SDOW: Shorting the Dow Jones Index

SDOW contracts offer speculators a potent method for multiplying their positions on the Dow Jones Industrial Average. Leveraging 3x leverage, savvy traders can possibly magnify their returns when shorting this prominent index. However, it's vital to grasp the inherent dangers associated with such high leverage before venturing. A well-defined approach, coupled with rigorous control, is indispensable to mastering the volatile world of short selling SDOW contracts on the Dow Jones.

- Keep in mind that losses can top your initial capital.

- Meticulous market analysis is necessary.

- Asset distribution can mitigate overall risk.

Exploring the Risks and Rewards of SDOW: A 3x Short Dow ETF Analysis

The volatile nature of the stock market often presents investors with both significant risks and potential profits. Among the various investment vehicles available, exchange-traded funds (ETFs) have surged in popularity due to their flexibility and affordability. One such ETF that has drawn attention is the Amplified Short Dow ETF (SDOW), a product designed to generate returns that are tripled the inverse performance of the Dow Jones Industrial Average.

However, investing in leveraged ETFs like SDOW is not lacking in its own set of risks. The inherent leverage amplifies both profits and losses, meaning that while SDOW has the potential to produce substantial returns during bearish market conditions, it can also result in substantial losses when the market is bullish.

Therefore, it is vital for investors to carefully understand the risks and rewards associated with SDOW before committing any capital. This analysis will delve into the functioning of SDOW, explore its potential for both profit and loss, and provide traders with crucial insights to make informed investment decisions.

Is SDOW Right for You? Evaluating the ProShares UltraShort Dow30 ETF

The ProShares UltraShort DOW (SDOW) offers investors a leveraged way to hedge against the Dow Jones Industrial Average. While it can be a valuable addition to a portfolio, it's not suitable for everyone. Before jumping in , it's crucial to evaluate your investment goals .

- SDOW amplifies gains and losses by 2x, meaning a 1% move in the Dow would result in a 2% change in SDOW's price. This leverage can be beneficial during market downturns , but it also increases the risk of significant setbacks.

- Traders must have a high-risk tolerance as SDOW can be prone to sharp swings .

- SDOW is best suited for short-term traders rather than long-term passive portfolio managers. Its leveraged nature makes it unsuitable for those seeking steady returns .

Ultimately, the decision to invest in SDOW should be based on your financial goals.

Conquering Short Selling Strategies with SDOW: A Comprehensive Guide

Unleash the power of short selling with SDOW, a cutting-edge strategy that can amplify your returns in volatile markets. This in-depth guide will equip you with the knowledge and tools to navigate the complexities of short selling, pinpointing lucrative opportunities and mitigating inherent risks. From understanding the fundamentals of SDOW to implementing advanced techniques, we'll delve into every aspect of this powerful strategy, providing you with a comprehensive roadmap to success.

- Learn the intricacies of short selling and its potential for profit in various market conditions.

- Delve into the SDOW methodology and how it distinguishes itself from traditional short selling strategies.

- Refine key risk management techniques to protect your portfolio from unexpected volatility.

- Cultivate a robust trading plan tailored to your individual goals and risk tolerance.

Arm yourself with the expertise to confidently implement SDOW strategies and achieve sustainable returns. Don't miss this opportunity to unlock the full potential of short selling.

Josh Saviano Then & Now!

Josh Saviano Then & Now! Ross Bagley Then & Now!

Ross Bagley Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Tonya Harding Then & Now!

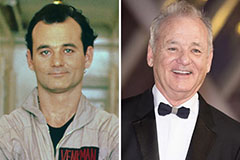

Tonya Harding Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!